Inspiring: Reimagining the Economy News Stories

Below are key excerpts of inspiring news articles on reimagining the economy from reliable news media sources. If any link fails to function, a paywall blocks full access, or the article is no longer available, try these digital tools.

For further exploration, delve into our Inspiration Center.

A small but growing number of cash-strapped communities are printing their own money. Borrowing from a Depression-era idea, they are aiming to help consumers make ends meet and support struggling local businesses. Businesses and individuals form a network to print currency. Shoppers buy it at a discount say, 95 cents for $1 value and spend the full value at stores that accept the currency. Workers with dwindling wages are paying for groceries, yoga classes and fuel with Detroit Cheers, Ithaca Hours in New York, Plenty in North Carolina or BerkShares in Massachusetts. Ed Collom, a University of Southern Maine sociologist who has studied local currencies, says they encourage people to buy locally. Merchants, hurting because customers have cut back on spending, benefit as consumers spend the local cash. Jackie Smith of South Bend, Ind., who is working to launch a local currency, [said] "It reinforces the message that having more control of the economy in local hands can help you cushion yourself from the blows of the marketplace." During the Depression, local governments, businesses and individuals issued currency, known as scrip, to keep commerce flowing when bank closings led to a cash shortage. Pittsboro, N.C., is reviving the Plenty, a defunct local currency created in 2002. It is being printed in denominations of $1, $5, $20 and $50. A local bank will exchange $9 for $10 worth of Plenty. "We're a wiped-out small town in America," says Lyle Estill, president of Piedmont Biofuels, which accepts the Plenty. "This will strengthen the local economy. ... The nice thing about the Plenty is that it can't leave here."

Note: For a treasure trove of great news articles which will inspire you to make a difference, click here.

Ideas for co-ops may flourish, but few people understand exactly how to make theirs real. The Co-op Academy is providing answers. Founded four years ago by Omar Freilla (who recently made Ebony magazines list of the Power 100), the academy runs 16-week courses that offer intensive mentoring, legal and financial advice, and help designing logos and websites. Run by the South Bronx-based Green Worker Cooperative, the academy guides up to four teams per session through the startup process and has graduated four organizations now thriving in New York City. These include Caracol Interpreters, which is raising the bar on interpreter wages, and Concrete Green, which focuses on environmentally sound landscaping. Six more co-ops are in the pipeline. Im amazed at how little knowledge and information is out there for the average person about how co-ops function and how to start one, says Janvieve Williams Comrie, whose mother-owned cooperative Ginger Moon also came out of the program. Thats one thing the Co-op Academy really provides, the hands-on know-how. Even money for tuition ($1,500 per team) gets the treatment. Freilla is adamant that teams fundraise to cover that costeven if they can foot the bill themselves. By fundraising for the registration fee, you are promoting the vision for your cooperative, gaining supporters, and creating a buzz before the program even starts, he says. That is just the kind of support that will propel your business forward, and while youre doing it youll be getting an early opportunity to see just how well you and your teammates work together.

Note: For a treasure trove of great news articles which will inspire you to make a difference, click here.

The milieu at Shantivan, a garden in Mumbais tony Malabar Hill area, on February 17 was like a hangover from Valentines Day. Placards displaying messages like Love is all we need were tied to tree branches. The occasion was the second monthly lunch hosted by Seva Caf. Omnipresent at the venue was a bespectacled man [named] Siddharth Sthalekar, who was orchestrating this generosity enterprise. About three years ago, he was the co-head of the derivatives trading desk and the head of algorithmic trading at Edelweiss Capital. [One] morning in 2010 [he took the decision] to throw it all away. For some time, the 31-year-old Mumbaikar had been contemplating quitting his cushy job to explore if there is an alternative to the premise of accumulation that seemed to drive individuals in the corporate world. When he finally took the plunge, he set out to travel across India with his wife Lahar. Over the next six months, as they visited several non-profit organisations, they woke up to the concept of gift economy where goods and services are extended without any formal quid pro quo. This motto formed the cornerstone of Moved by Love, an incubator at Gandhi Ashram in Ahmedabad, which carries out various projects. One such project, Seva Caf, was in hibernation. Sthalekar ... and his wife became its core volunteers and helped reopen it in September 2011. Seva Caf practises giving, the antithesis to accumulation. At the caf, volunteers cook and serve meals every week from Thursday to Sunday for free. What is Sthalekars takeaway from the experiment? The idea, he says, is to trust the assumption that every individual, irrespective of his economic standing, can be generous. [He] hopes that people will develop the habit of being generous even outside the cafin all environments and circumstances.

Note: For a treasure trove of great news articles which will inspire you to make a difference, click here.

Icelanders who pelted parliament with rocks in 2009 demanding their leaders and bankers answer for the countrys economic and financial collapse are reaping the benefits of their anger. Since the end of 2008, the islands banks have forgiven loans equivalent to 13 percent of gross domestic product, easing the debt burdens of more than a quarter of the population, according to a report published this month by the Icelandic Financial Services Association. You could safely say that Iceland holds the world record in household debt relief, said Lars Christensen, chief emerging markets economist at Danske Bank A/S in Copenhagen. Iceland followed the textbook example of what is required in a crisis. Any economist would agree with that. Most polls now show Icelanders dont want to join the European Union, where the debt crisis is in its third year. The islands households were helped by an agreement between the government and the banks, which are still partly controlled by the state, to forgive debt exceeding 110 percent of home values. On top of that, a Supreme Court ruling in June 2010 found loans indexed to foreign currencies were illegal, meaning households no longer need to cover krona losses.

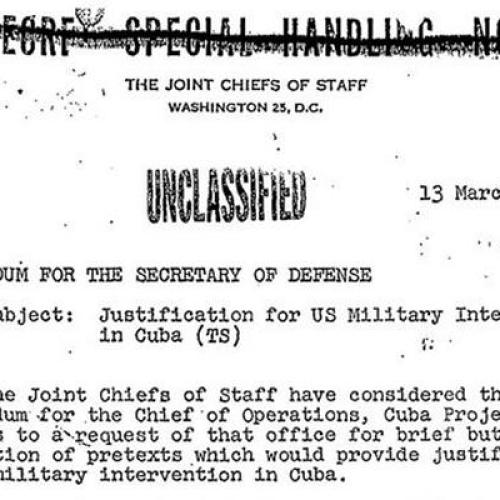

Note: The amazing story of the Icelandic people demanding bank reform is one of the most underreported stories in recent years. Why isn't this all over the news? To see what top journalists say about news censorship, click here. For blatant manipulations of the big banks reported in the major media, click here.

Jessica ... lives what some might consider the perfect alternative lifestyle. She makes enough money to pay for rent and food (from the farmer's market) by teaching classes at the Solar Living Institute and selling her self-published zine about alternative fuel. She grows much of her own food and raises chickens and bees in her backyard. As a child, her family life centered around growing food and cooking meals together. Her parents never emphasized money. She hasn't strayed far from her upbringing. When asked about her views on money, she said: "It's better to be happy than to worry about your credit card bill or working a lot." One of the key points of being happy, for Jessica, is to bank at Cooperative Center Federal Credit Union. Jessica's made it a point to convert her friends to using credit unions, which are nonprofit banks. "I say to people: So you shop at a farmer's market. You use alternative fuel or bike or take public transportation. But you still bank at Bank of America?" She laughed at the paradox of the small-is-beautiful crowd supporting a global corporation. "With banks, it's a business and all your money goes to make someone you don't know rich -- but with credit unions, all the money goes back into the community," Jessica explained. "It's people banding together to share the abundance." Credit unions -- also called cooperative banks or people's banks -- have origins in Europe. They were first started by German farmers in the 1860s who felt private banks were charging unfair fees. These rural people pooled money together in order to make loans within their tight-knit community. In North America, the idea of credit unions was first embraced by Canadians. These days in the United States, there are over 8,000 credit unions; 536 of them are in California.

Note: To locate a credit union near you (in the United States), click here.

Important Note: Explore our full index to revealing excerpts of key major media news stories on several dozen engaging topics. And don't miss amazing excerpts from 20 of the most revealing news articles ever published.